Independent Financial Resource Consultant

Divorce Mediator

Hello, Friends,

As you will gather from this web site, the Adams’ Mediation & Financial Resource Center is a unique business, like no other. Clients call me when they need information and assistance dealing with financial matters and divorce issues. The skills and experience needed to develop this type of business requires an unusual combination of academic background and professional experience.

Whenever we seek information or service, the credentials of the provider are important. Of equal importance, but far harder to discern, are the values and beliefs of the person we must rely upon for the most critical decisions in our lives. When Patti Gras, award-winning journalist for PBS Houston, invited me to appear on her “Living Smart” series, she recognized the wisdom of learning about her guests’ values and beliefs. Without this information, her interview would reveal only the facts rather than the substance of who I am. With this in mind, I want to share some personal thoughts, rather than merely listing my education and achievements.

Work, Money, & Control

My father owned a general store in a small town in Illinois. As soon as I could put candy bars on the shelves, I had “employment.” Usually employment is work for which one is compensated. Since I wasn’t receiving pay, it was more like mandatory volunteer work. My unwritten job description quickly expanded to sweeping floors and operating the cash register. Then, I received a quarter a week. Perhaps I could be listed in the Guinness Book of Records as the youngest check-out girl. How times have changed! I have a special appreciation for bar codes.

Those experiences no doubt contributed to my current belief:

The sooner we connect our work with money, the better we take care of ourselves. The more years we are dependent on others (parents, spouse, etc.), the more difficult it is to be independent and financially secure.

To seek “financial independence” is to express a value. In some cultures with communal values and in certain personal relationships, this type of independence is neither important nor desired. If we choose to be financially dependent, then we must accept the outcomes and live with the consequences of decisions made by the person who has control of the finances.

Belief: Individuals who have money, have more control of their lives and the ability to make appropriate choices!

Savings & Boundaries

As I earned quarters for working in my father’s store, he became my banker. Each week, he entered 25 cents in a small ledger. When I wanted to buy something, I withdrew the appropriate amount. I quickly learned the concepts of saving and establishing financial boundaries.

Belief: A saving habit is best established early in life.

Laury teaches the Spring Branch children to play the money game.

When I present Money Game programs to children, I ask if they can commit to saving one cent of every dollar that comes into their hands. After attending a program, Jessica, a Houston Spring Branch middle school student, encouraged her parents, siblings, aunts, and uncles to adopt this savings plan. They collected their coins in creative containers--piggy banks, shoe boxes, zip lock bags, etc. The family is shown in the introduction to my two Houston PBS interviews on “Living Smart.”

Belief: Living within our financial boundaries helps us avoid the “Debt Dungeon.”

As I write this, our country is awash with debt! We have become a debt-laden “credit card” society. Our government has incurred the largest debt ever, our financial institutions have engaged in irresponsible lending, and individuals are losing their homes in record foreclosures.

Living within one’s financial boundary is often difficult, but a commitment to do so can force us to be unusually resourceful. When my former husband worked on his doctorate degree, we lived on his graduate assistantship stipend while raising three children. We couldn’t afford baby food, so I shopped for vegetables at the Seattle Farmers’ Market and pureed them in a blender. When we couldn’t afford to purchase new home furnishings, I bought 10 cent carpet samples and sewed them together to carpet our living room.

There may be times when we can’t afford to have the lifestyle we want, so we must live in the lifestyle we can afford. Too often, we purchase, then plan to pay.

Belief: We can avoid debtor’s stress if we always plan to pay, then purchase!

EDUCATION

Formal education is high on my list of values. My academic studies were interesting and challenging, but I never thought of them as preparation for a career. In fact, I was more “domestically inclined” with a goal of being a perfect wife and mother.

By attending summer sessions (one at UCLA to find a husband), I graduated from Northwestern University in three years. My intention was never to enter a classroom again. But later in life, some unexpected realities confronted me. During the 1970’s, I was the wife of a professor. While my husband was teaching at Purdue University, I decided to join the League of Women Voters in Lafayette, Indiana. We studied the Equal Rights Amendment and researched women’s rights.

We were living in a separate property state, and I was appalled to learn the decisions I had made to be a traditional wife and mother could make me one of the bag ladies I was reading about! I couldn’t get a credit card in my own name, and the laws, at that time, would grant me no right to any portion of my husband’s savings in his University retirement plans. His Social Security record accrued during our marriage was not divisible. I would be able to receive partial future benefits only if I met the “ten year vesting” requirement. Laws regarding retirement plans have changed, but not Social Security.

It seemed that employment was the answer to my future financial security. I had deceived myself into thinking that my undergraduate degree from Northwestern University would be quick enter into the job market. Wow, what a shock! The best job I could find in that small town was equivalent to the one my son had at the local burger joint.

Necessity is the “Mother of Invention”

That sparked my entrepreneurial spirit. I started buying large old homes near the university and converting them to student apartments by dividing, renovating, and creatively decorating the spaces. Surprisingly, I was named “Landlord/lady of the Year” by the students!

Graduate School

At this same time, Betty Nelson, a dear friend working in Purdue’s administration, kept giving me information about classes at the university. One day, I found the courage to set up an appointment with Dr. Flora Williams to get information about studies offered in their School of Consumer & Family Science. Dr. Williams started one of the first university programs in Financial Counseling. It was most unexpected when she asked me to apply for an assistantship position that was available in the fall.

That meant that I would have to take the Graduate Record Exam! YIKES!!!!!! In my early years, I had been an A+ student in math, but never expected to use any of those skills again, so had forgotten most of what I had learned. I studied for the exam each day. My son, Barry, came home from high school and tutored me on the math section.

Awakening Women to Social Security

My graduate classes were challenging and rewarding. I earned a Master’s degree and valuable experience working in Purdue’s financial counseling service. Dr. Williams served as my advisor when I wrote my thesis in 1978: Women’s Knowledge of Social Security and How it Affects Them.” Today, I am actively promoting INFORMED REFORM in Social Security with hopes that the underlying social structure can be revised before quick “fiscal fixes” are adopted.

BUSINESSES & ANOTHER CAREER

While completing my thesis, I was packing our household belongings to prepare the family for a move to Texas where my husband had taken a teaching position at the University of Houston. It was exciting to start my own financial consulting business, Family and Consumer Financial Services.

During the first two years in Houston, I also taught Personal Finance and Consumer Science courses at the University of Houston. The Golden Key National Honor Society honored me with their Excellence in Teaching Award.

Mediation Expands Possibilities

We never know how one small event in our life might affect our future. In 1982, I was in a small group of women listening to attorney, Alece Egan, explain divorce mediation. She was one of the pioneers who had been trained as a mediator and was introducing the process to Houston.

Clients who consulted me after divorce were dropping their decrees on my table with no understanding of the assets and liabilities they had received in their divorce settlement. Mediation seemed like a perfect opportunity to educate and empower people during the divorce process, so they could make wise decisions regarding their future finances and parenting their children.

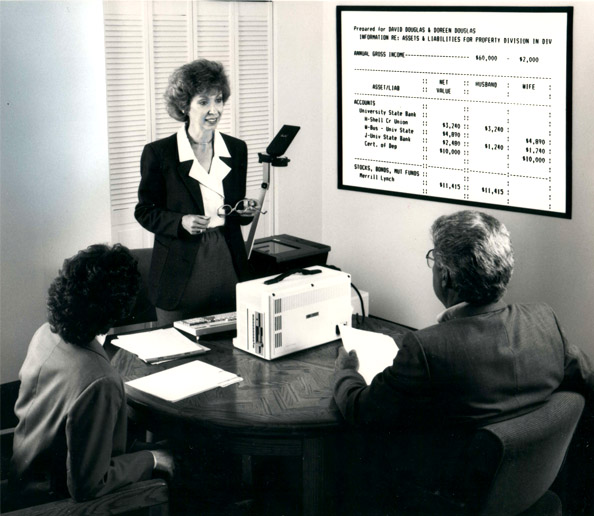

In 1982, I completed training as one of Houston’s early family mediators and enrolled in legal and tax courses in order to provide a quality service to my clients. With the advent of the computer, I immediately saw the possibilities for using it with parties in divorce, thus, I became the first person in the country to use computer technology in working with divorce clients. Subsequently I developed interactive software for clients to use in preparing for divorce. That has evolved into DivorceSavvySavesMoney, now sold on the Internet.

When I added family mediation to my services, I also changed my business name to the Adams’ Mediation & Financial Resource Center .

Lee Borden is an attorney in Birmingham, AL who contacted me about his interest in my computer work. He is the best partner! We both have a commitment to working in our clients’ best interest, so it was easy to agree on our mission. All our work is done with the purpose of making divorce more understandable, more efficient, and more effective.

Lee created a Web site with more free divorce information than any other Internet site . I often say, “Lee tells you everything you want to know and don’t want to know about divorce.” His achievements are monumental, so you will find links from this Web site to his, www.divorceinfo.com

From the time I first became a mediator, I have participated in professional activities on local, state, and national levels and most of those years I held an office in the organizations. In 1991, I was the president of the Texas Association of Mediators. Mediation is a multi-disciplinary profession so mediators share information from their academic training. Each year, I have taken continuing education courses, and in many of the years, I have presented programs to other professionals. In 1995, the Academy of Family Mediators invited me to present a financial segment in an educational video they were producing, “Creative Options for Mediating Support.

Contributions of Financial Information to the community through the media:

Television:

“Good Morning, Houston” local ABC morning show– presented segments on personal finance

“Living Smart” PBS Houston – invited to be the featured guest on two half-hour shows to discuss personal finance and Social SecurityNews Publications:

Houston Chronicle - Interviewed for various news features.

Authored “Money Talks” column for Matrix Magazine and wrote articles for Health Parade

COMMUNITY PARTICIPATION

Sharing with others is one of life’s most meaningful experiences. During my years in Houston, I’ve served on committees and the Executive Boards of the Houston Women’s Center and The Women’s Resource. It’s been rewarding to actively participate in many activities and help these organizations fulfill their missions. It was an honor to receive The Women’s Resource Volunteer of the Year Award for 2005.

Receiving the award.

While running my business, I’ve presented countless programs on finance and conflict resolution to churches, businesses, and community groups. Giving of one’s time, talents, efforts, and money definitely has a "boomerang” effect, for the satisfaction one receives is immeasurable!

TODAY’S BUSINESS

The Adams’ Mediation & Financial Resource Center assists people in handling the most challenging matters inherent in every-day living—managing money and dealing with conflict. The purpose is to provide valuable information and teach essential skills that empower individuals to successfully deal with their finances and resolve conflicts.

Please explore the sections of this web site that hold the most interest for you. The purpose is not to “reinvent the wheel,” so you can link to other web sites that will be very helpful.

MY OFFICE

From 1979 through 2000, I had an office at various locations in west Houston. The concept of live/work space appealed to me so I searched for a lot where I could design and build my own building. Yep, it was a lot of work—and looking back that seems to be an understatement. In the summer of 2000, I was able to start seeing clients in my new space. My office is in Unit #2 at 114 Arnold St., Houston, TX 77007. I live in Unit #1 and there are two upstairs apartments.

My office is just a few minutes from downtown—north of Memorial Drive, between Shepherd and Westcott. The central location has proven to be ideal. Freeways make it easy for clients to come from Galveston, Sugar Land, Katy, the Woodlands, and other surrounding areas.

MY PERSONAL LIFE

If you have read the previous sections, you have gathered some information about my personal life. Like most people, my years have been filled with highs and lows; with joys and disappointments.

The “highs” enable me to maintain a positive outlook on life. The “lows” have tested my strengths and have helped me develop a special sensitivity to the unique needs of each client and/or friend.

I have three adult children and five grandchildren. Evan is my oldest grandchild whose talents are surpassed by his winning personality. You see his talents displayed on this Web site—it is his design. He’s my favorite web designer!

Laury gives Evan first computer lesson Evan teaches Laury new tricks

I got it!

When I became a divorce mediator, I never thought I would confront the dreaded “d.” Sadly, I was divorced after many years of marriage. I have had to “walk the talk.” I have a friendly relationship with my former husband and his wife. Happily, Brent Barker has been a Very Special Person in my life for a long time and is now renting one of my apartments!

Over the years, I have offered a quality service to those I serve. But my success can be attributed to my wonderful clients and other professionals (attorneys, therapists, CPAs, etc.) who have provided related services.

Please let me know if I can assist you by providing any of the services mentioned on this web site.

Your success is my business!

Laury Adams

Email: Lauadams@aol.com

Phone: 713-898-2263

Address: 114 Arnold Street

Houston TX 7707-7268

Directions to my office

An internet map will be helpful, but you may also want to use the following directions.

Directions to 114 Arnold St., Houston, TX 77007

From Katy I-10

Exit Durham/Shepherd

Drive south on Durham

Turn right on Feagan (Shell station on SE corner)

Left on Reinerman, go to Dead End

Right on Chandler

Right on Arnold

From WEST: Drive East on Memorial Drive past the pak

Turn Left on Detering (at Stop light – Left Bank Apts)

Right on Feagan (Stop sign)

Right on Reinerman

Right on Chandler

Right on Arnold

From EAST: Drive West on Memorial Drive

Turn Left on Detering (at Stop light – Left Bank Apts)

Right on Feagan (Stop sign)

Right on Reinerman

Right on Chandler

Right on Arnold

From So Shepherd

Drive North; Take overpass over Memorial Dr.

Turn Left on Dickson in front of Shell

Left on Reinerman, go to Dead End

Right on Chandler

Right on ArnoldFrom Galveston:

I-45 to downtown Houston

Exit Allen Pkwy (exit on your Left)

Drive past Waugh Dr.

Turn right on Shepherd under bridge

Go under bridge and up hill on your right

To get to upper Shepherd,

Take an immediate Left on Dickson

Left on Reinerman, go to Dead End

Right on Chandler

Right on ArnoldFrom Sugar Land

I-59 to 610 North

Exit Woodway/Memorial

Woodway runs into Memorial

Drive East pass Memorial Park

Turn Left on Detering (at Stop light – Left Bank Apts)

Right on Feagan (Stop sign)

Right on Reinerman

Right on Chandler

Right on Arnold